Times of crisis bring unpredictability to demand and consumer purchasing patterns. But an array of tools can help companies navigate through challenging times. For airlines, a smart loyalty program can be one of them.

Data is key to detecting changes to demand and market behavior. While macro data can help identify industry-wide patterns, loyalty programs are uniquely positioned to help airlines drill down further. Correctly managed, these programs allow airlines to detect detailed changes in consumer behavior by segment or at an aggregated level, and associated revenue generation and protection opportunities. These insights can help airlines accelerate recovery, retail more effectively, and even shape new behaviors.

So, let’s have a look at how smart loyalty programs can help airlines on the road to recovery.

Dynamic rather than static segmentation

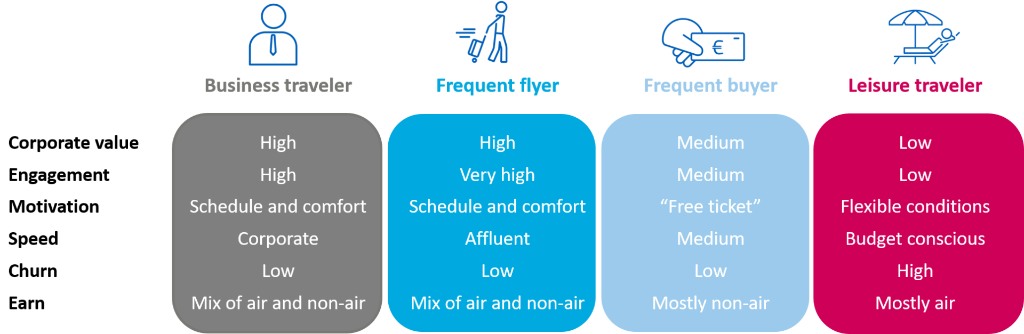

Working closely with our customers over the years, we have seen a wide range of segmentation techniques and criteria used by airlines. A fundamental question that needs to be asked is: how relevant will traditional and static airline loyalty segments be in the immediate future?

Reassessing available data is the only way to know the answer. These segments and their associated targeting strategies no longer work if a corporate travel policy has changed, or if the member has become unemployed and travel ceases to be a priority.

Early identification and understanding of new consumer behavior, expectations, and priorities are needed to define and build new data-driven segmentation. These new segments will also likely evolve in line with market changes.

Using all available data to build new and dynamic segments will help maximize marketing accuracy and identify members with the highest potential to fill planes again.

Aside from demographics (name, age, gender), airline loyalty programs have a wealth of data that can be used to segment members, such as:

- Firmographics: organization name, work address, and industry;

- Behaviors: purchase and engagement activity, look-to-book ratio, and conversion score;

- Feedback scores from surveys;

- Partner data: bank partners, and air and non-air partners;

- Competitive data: membership in other frequent flyer programs, and share of wallet;

- Loyalty data: points balance, length of membership, CRM lifecycle, previous and future flights, customer lifetime value, and tier history;

- Psychographics: values, preferences, lifestyle, interests, and hobbies.

So, what should take precedence when defining a segment? Aspects to be considered include consumer shopping behavior, both for air and non-air services within an airline’s loyalty program, relevant learnings from loyalty programs in other sectors, along with KPIs that define truly loyal members of an airline’s reward program. Individual customer contribution varies greatly, especially as the industry recovers. Dynamic segmentation enables airlines to focus on growing members with potential and rewarding truly loyal members, while deprioritizing unprofitable customers who divert attention and resources.

Personal beats generic

As most businesses recover (not just competing airlines), customers will likely receive more promotions and offers than ever before. Little will be personalized. Most will be via e-mail.

Today, membersincreasingly expect an easy-to-understand program that:

- Rewards their efforts;

- Fits their needs and values;

- Carefully uses their personal data for their benefit.

How can an airline differentiate its loyalty program from that of its competitors and make that difference stand out to its loyal members?

Again, using data. Loyalty programs have huge amounts of data that can be used to better communicate with an airline’s segmented audience through:

- Effective targeting and engaging with members in a way that surprises and delights;

- Creative, segmented and differentiated offers that integrate airline partners;

- Showcase how program members receive unique, personalized offers versus one size fits all.

Apowerful loyalty program

provides members differentiated, personalized, and added-value benefits, not just mileage accrual or run-of-the-mill offers, which lead to higher conversion and revenues. Bain & Company estimates thatloyal customers spend up to 67% more,

refer more people, and are more willing to purchase more products from a company. The consultancy alsoestimates that a 5% increase in retention can lead to a 95% increase

in profit. So, now is the time for loyal airline customers and data-led loyalty programs to lead recovery.

Rewarding loyalty

Beyond simple earn-and-burn recognition, we see smart loyalty programs drive higher engagement by providing:

- More spend options on air and non-air products and services to increase program value and attractiveness;

- New rewards that use customer data to resonate with members;

- Targeted and contextualized offers with optimized miles values;

- More opportunities for members to use miles on desired flights.

The more members can see the added value of an airline’s loyalty currency, the more they will desire it. Several airlines recently launched bonus campaigns to incentivize the purchase of miles. As we have seen from certain customers, members who desire an airline’s currency will use cash to acquire it. Ultimately, improving redemption options will drive extra advocacy and engagement and lead to additional operational and marketing revenue.

Creating loyalty tailwinds for airline recovery

Various airlines have built up their loyalty programs into sizeable assets and even recently used those as collateral to secure financial assistance during these challenging times. So now is a key moment for loyalty programs to improve how airlines use available data to personalize customer engagements to develop greater customer affinity. Loyal members are key to driving recovery and perceived loyalty benefits will pay back during the months and years to come.

TO TOP