-

Solutions

-

Airlines

-

Airports

-

Border Authorities

-

Corporate Travel & Expense

-

Integrations

-

Travel Sellers

-

-

Payments & e-invoicing

-

Unlocking the power of AI agents in travel

Unlocking the power of AI agents in travelIn this whitepaper, Amadeus and Microsoft explore how AI agents and modern data platforms are improving travel at every stage.

Learn more -

Traveler behavior is changing at every touchpoint

Traveler behavior is changing at every touchpointExplore bold ideas, lead with cutting-edge tech, build powerful partnerships, and contribute to lasting impact.

Learn more

-

-

Support & Training

-

Already a customer?

Already a customer?Log into Amadeus Service Hub for product news, learning materials, and customer support.

Login

-

-

-

Transforming travel with AI

Transforming travel with AIOur partnership with Microsoft accelerates our Cloud journey and unlocks new, AI‑powered innovations that strengthen and elevate the travel industry.

Learn more -

Landmark partnership between Amadeus and Google Cloud

Landmark partnership between Amadeus and Google CloudLearn how this collaboration strengthens Amadeus' multi-cloud approach and AI innovation to improve efficiency, reliability and growth in travel.

Learn more

-

-

Resources

-

Connected journeys: How will technology transform travel in the next decade?

Connected journeys: How will technology transform travel in the next decade?From AI-driven planning and biometric check-ins to smarter disruption management.

Read the report -

Six travel trends that will redefine how we travel in 2026 and beyond

Six travel trends that will redefine how we travel in 2026 and beyondAmadeus, in collaboration with Globetrender, unveils the tech, policy and innovation coming to transform the face of travel.

Discover now

-

-

Company

-

About Amadeus

-

Careers

-

-

Sustainability (ESG)

Learn how we’re working to make travel a force for good.

-

AI at Amadeus

AI at AmadeusDriving integration, scalability, trust and integrity across the travel industry.

Learn more -

-

-

Over the past years, we have seen additional administrative burdens, increased complexity of reporting, and close scrutiny as a result of the newly enforced compliance requirements such as the Posted Workers Directive, a topic which we talked about in a previous blog. Staying up to date, and managing all the tax and legal implications of business travellers has become a huge challenge for many companies. It can prove especially difficult for ente

The economic employer concept in Europe: a new challenge for HR, GM & risk managers

Over the past years, we have seen additional administrative burdens, increased complexity of reporting, and close scrutiny as a result of the newly enforced compliance requirements such as the Posted Workers Directive, a topic which we talked aboutinaprevious blog . Staying up to date, and managing all the tax and legal implications of business travelers has become a huge challenge for many companies. It can prove especially difficult for enterprises to cope with the mobility of their employees without risks, and especially, to be compliant with the new rules across different countries that change regularly.

Today, we will talk about another new challenge: the economic employer concept. Here are some highlights of the main implications and associated risks when managing global mobile talent including the Economic Employer Concept and theDouble Taxation concept .

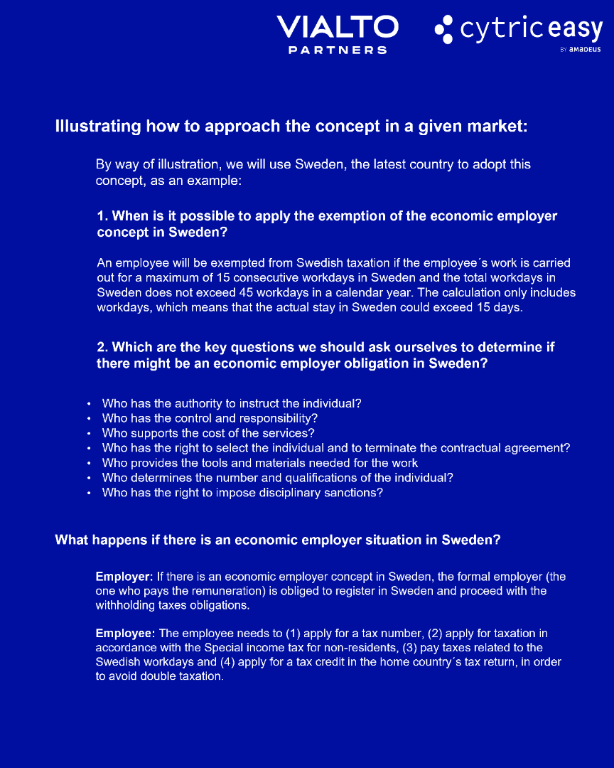

The concept of economic employer is not a new one in Europe, as it has been adopted by many countries: Austria, Denmark, Germany, Hungary, Norway, the Netherlands, …, and, the last one, Sweden, as of January 1st, 2021. Finland planned to introduce the economic employer concept in its legislation as of January 1st, 2023, but finally, the new rule has been withdrawn, and this economic employer concept will not yet be applied for this year. However, it remains a hot topic in Finland right now.

This concept is important as more and more countries are implementing this new sense of employer (instead of the “formal” approach). The bottom line is that it impacts the reporting and taxation of the employers and employees running activities in the aforementioned countries, and it says that the employer is not the entity who pays and bears the cost (formal employer), but the entity whose authority and supervision the employee carries out the work (economic employer).

Understanding exemptions to the general rule

The general rule is that the employment income received by the employee is taxed in the country where the services are performed. However, there is an exemption in the double tax treaties[1]signed between the home and host country, for those countries who do not follow the economic employer concept. This exemption is regulated in article 15 of the OECD model tax convention. Under this “183-day-rule”, the employment income is taxed in the country of residence (home country) only, if some conditions are met:

- The recipient is present in the other State for a period or periods not exceeding in the aggregate 183 days in any twelve-month period commencing or ending in the fiscal year concerned, and

- The remuneration is paid by, or on behalf of, an employer who is not a resident of the other State, and

- The remuneration is not borne by a permanent establishment which the employer has in the other State.

The challenges for those countries following the economic employer concept is that the “183-day-rule” might not be applicable. First, companies need to determine whether an exception or threshold of days to avoid the economic employer situation is applicable, and secondly, if the exception is not applicable, analyze if there is an economic employer situation or not.

[1]Agreements made between two or more countries to solve issues related to the avoidance of double taxation.

Working in partnership to help you make the right decisions

Together with Amadeus, we have created technology that provides an end-to-end solution to manage your business travelers’ risks from pre-planning, to case by case assessments through to post-traveldata driven reporting and completion of downstream compliance actions, harnessing automation in the majority of cases: Cytric Easy by Amadeus & Vialto's myTrips.

It's clear the challenge of meeting corporate compliance regulations is growing ever more complex. That’s why it has never been more important to work with trusted partners that can help your business successfully navigate the changing landscape. Along with proven technology that supports business travelers wherever they may be in the world, expert guidance on the development of corporate policies that enable you to meet your duty of care obligations are vital. These are the building blocks for success in our globally interconnected world.

To read more on this topic, download our paperBusiness travel compliance & policy for remote workers

here.

TO TOP