Second quarter highlights (three months ended June 30, 2021 compared to Q2 2019)

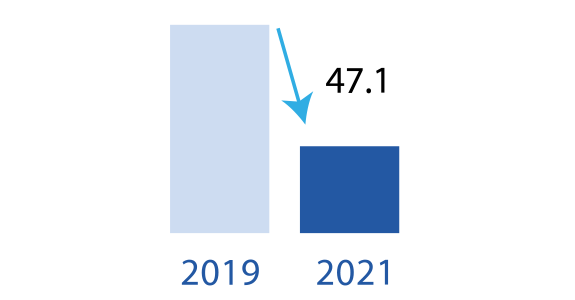

- In Distribution, our travel agency air bookings decreased by 67.6%, to 47.1 million, an improvement of 11.6 p.p. over its first quarter of 2021 performance.

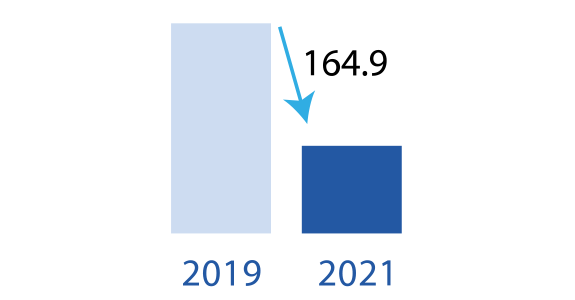

- In IT Solutions, our passengers boarded declined by 67.7%, to 164.9 million, an improvement of 3.1 p.p. over its first quarter of 2021 performance.

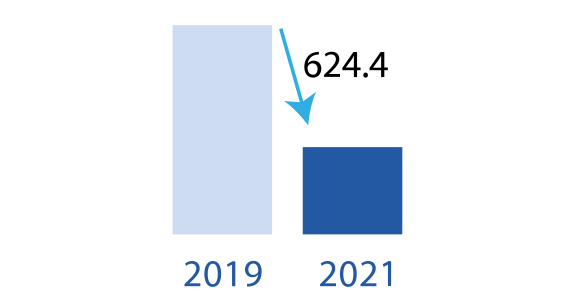

- Revenue contracted by 56.0%, to €624.4 million, an increase of €127.7 million relative to the first quarter of 2021.

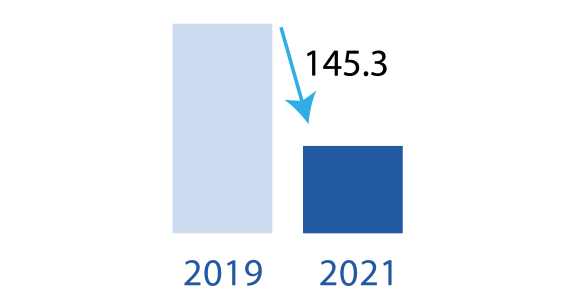

- EBITDA1decreased by 75.3%, to €145.3 million, an increase of €91.6 million relative to the first quarter of 2021.

- Adjusted profit2contracted by 107.2%, to a loss of €23.6 million, an improvement of €59.5 million relative to the first quarter of 2021.

- Free Cash Flow3amounted to -€110.0 million, or -€78.5 million excluding cost saving program implementation costs paid.

- Net financial debt4 was €3,255.8 million and liquidity available5 amounted to c.€3.4 billion, at June 30, 2021

Luis Maroto, President & CEO of Amadeus, commented:

“Building on the trends already seen in the first quarter, air bookings and passengers boarded have gradually improved each month and accelerated in June, which has been the best performing month since the start of the pandemic. In parallel to this gradual recovery, we remain committed to our cost optimization efforts and supporting our customers".

“During the first half of the year we have maintained commercial momentum, signing 37 new contracts or renewals in our Distribution business, and progressing with our NDC strategy. We have also signed new Airline IT solution agreements with major airlines, while in our Hospitality business, we expanded our portfolio of customers and saw continued demand for partnership developments".

“In the coming months, we are optimistic that, as vaccination programs keep progressing, travel restrictions are lifted, and traveler sentiment continues to improve, this should translate into a more consistent and stronger recovery over time”.

[1] Adjusted to exclude costs incurred in the second quarter of 2021, related to the implementation of the cost saving program announced in the second quarter of 2020. These costs relate mostly to severance payments and amounted to €4.2 million in the second quarter of 2021 (€3.0 million post tax). See section 3 for more details.

[2] Excluding after-tax impact of the following items: (i) accounting effects derived from PPA exercises and impairment losses, (ii) non-operating exchange gains (losses), (iii) costs related to the implementation of the cost saving programs and (iv) other non-operating, non-recurring effects.

[3] Defined as EBITDA, minus capex, plus changes in our operating working capital, minus taxes paid, minus interests and financial fees paid.

[4] Based on our credit facility agreements’ definition.

[5] Composed of (i) cash and cash equivalents, net of overdraft bank accounts (€1,488.9 million), (ii) short term investments, net of associated unrealized hedging results (€871.1 million) and an undrawn revolving credit facility (€1,000 million).

[6] Adjusted to exclude costs incurred in the first half of 2021, related to the implementation of the cost saving program announced in the second quarter of 2020, amounting to €19.3 million (€13.9 million post tax) in the first half, and €4.2 million (€3.0 million post tax) in the second quarter of 2021. See section 3 for more details.

[7] Excluding after-tax impact of the following items: (i) accounting effects derived from PPA exercises and impairment losses, (ii) non-operating exchange gains (losses), (iii) costs related to the implementation of the cost saving programs and (iv) other non-operating, non-recurring effects.

Q2 operating and financial highlights

Business evolution in the year

Distribution

In the second quarter of 2021, Distribution revenue amounted to €267.6 million, a contraction of 66.4% compared to the second quarter of 2019 and a notable improvement over the revenue performance delivered in the first quarter of 2021. The revenue in second quarter of 2020 amounted to -€15.9 million severely impacted by the pandemic.

The Distribution revenue contraction vs. 2019 resulted from the reduction in booking volumes explained below. Distribution revenue per booking diluted slightly vs. 2019, impacted by a negative effect from the cancellation provision and the higher weight of local bookings driven by the faster recovery in domestic air traffic compared to international air traffic. This was partly offset by contractions in non-booking related revenue lines, such as revenues from travel agency IT solutions, albeit at softer rates than the travel agency bookings decline.

In the second quarter of 2021, Amadeus travel agency air bookings declined by 67.6% compared to the second quarter of 2019, an improvement from the 79.2% air booking reduction we reported in the first quarter of 2021. The Amadeus air booking growth rates vs. 2019 gradually improved each month during the quarter, with an acceleration in the month of June.

All regions reported an increase in air bookings in the second quarter, relative to the first quarter of 2021 (vs. 2019). The regions that reported the largest growth rate were North America, which improved its booking performance from -67.9% in the first quarter to -48.9% in the second quarter, and Western Europe, which delivered an enhanced volume growth rate of -76.6% in the second quarter, compared to -89.3% in the first quarter of 2021. Central, Eastern and Southern Europe and Latin America also showed notable booking growth rate improvements in the second quarter.

Amadeus TA air bookings

Jul-Sep 2020 vs. 2019 |

Oct-Dec 2020 vs. 2019 |

Jan-Mar 2021 vs. 2019 |

Apr-Jun 2021 vs 2019 |

|

Western Europe |

(95.3%) |

(87.3%) |

(89.3%) |

(76.6%) |

North America |

(83.4%) |

(72.5%) |

(67.9%) |

(48.9%) |

Middle East & Africa |

(84.5%) |

(67.8%) |

(67.4%) |

(61.0%) |

CESE1 |

(78.0%) |

(71.5%) |

(67.6%) |

(55.5%) |

Asia Pacific |

(96.7%) |

(89.1%) |

(88.6%) |

(86.8%) |

Latin America |

(89.9%) |

(68.7%) |

(70.5%) |

(61.4%) |

Amadeus TA air bookings |

(89.8%) |

(79.4%) |

(79.2%) |

(67.6%) |

We remain committed to broadening and enhancing our content offering for our customers. During the second quarter, we signed 16 new contracts or renewals of distribution agreements with airlines, bringing the first half total to 37.

United Airlines renewed its distribution agreement with Amadeus, reinforcing its commitment to modern retailing and enhancing communication between the airline and travel sellers. Included in the agreement is the addition of new NDC-enabled content. NDC (New Distribution Capability) 6offers from Australia’s flag carrier, Qantas, are also available through the Amadeus Travel Platform to pilot agents for testing, and Qatar Airways entered into a Letter of Agreement with Amadeus to make its offer, including content via NDC, available globally. The airline is also looking to adopt Amadeus Altéa NDC from 2022 onward.

As part of an expanded distribution and IT partnership, LOT Polish Airlines will start to distribute new and tailored content through the Amadeus Travel Platform. The airline has chosen to deploy Amadeus Altéa NDC, which will offer new retailing and personalization opportunities consistently across multiple channels. With this technology, the airline will be able to distribute NDC-enabled offers in all its distribution channels.

Kenya Airways has selected Altéa NDC for the distribution of its NDC content and will connect to the Amadeus Travel Platform, which will provide the airline with reach throughout the global community of Amadeus’ connected travel sellers.

On the travel agency side, tiket.com will be the first online travel agency to adopt NDC in South East Asia. In addition, Seera Group extended its long-standing partnership with Amadeus to adopt NDC. As the Middle East’s leading provider of travel and tourism services, Seera Group will join Amadeus’ NDC [X] program and implement the NDC-enabled Travel API solution.

The customer base for Amadeus merchandizing solutions for the travel agency channel continued to expand. At the close of June, 120 airlines had signed for Amadeus Airline Fare Families and 176 airlines had contracted Amadeus Ancillary Services.

IT Solutions

In the second quarter of 2021, IT Solutions revenue decreased by 42.8%, to €356.8 million, compared to the same period of 2019. This revenue contraction was an improvement over prior quarters. It was also softer than the decline in our airline passengers boarded volumes thanks to the softer rate of decline in other revenue lines which are non-transactional (such as services, subscription-based or license-based revenues), or linked to transactions that have been less impacted by the COVID-19 pandemic such as in Hospitality. Compared to 2020, IT Solutions revenue in the quarter increased by 29.5%.

IT Solutions– Airline IT

In the second quarter of 2021, Amadeus passengers boarded decreased by 67.7%, to 164.9 million, vs. the same period of 2019. Passengers boarded growth rates improved every month, most notably in June. Compared to the second quarter of 2020, passengers boarded improved by 427.6%.

During the second quarter of the year, all regions except Asia-Pacific (impacted by the COVID-19 situation in India) and Middle East and Africa reported improvements in the passengers boarded performance relative to the first quarter. North America showed a clear acceleration, with passengers boarded declining by 19.8% in the second quarter, compared to a decline of 46% in the first three months of the year, all vs. 2019.

Total passengers boarded

Jul-Sep 2020 vs. 2019 |

Oct-Dec 2020 vs. 2019 |

Jan-Mar 2021 vs. 2019 |

Apr-Jun 2021 vs. 2019 |

|

Asia & Pacific |

(83.3%) |

(75.3%) |

(74.4%) |

(81.0%) |

Western Europe |

(75.7%) |

(83.1%) |

(88.0%) |

(81.5%) |

North America |

(58.9%) |

(58.0%) |

(46.0%) |

(50.7%) |

CESE1 |

(53.1%) |

(62.4%) |

(55.3%) |

(48.6%) |

Latin America |

(77.2%) |

(48.2%) |

(47.8%) |

(47.2%) |

Middle East & Africa |

(85.0%) |

(72.4%) |

(67.3%) |

(67.5%) |

Amadeus passengers boarded |

(74.9%) |

(72.4%) |

(70.8%) |

(67.7%) |

At the close of March, 208 customers had contracted one of the Amadeus Passenger Service Systems (Altéa or New Skies) and 201 customers had implemented one of them.

LOT Polish Airlines signed a renewal agreement covering a wide range of state-of-the-art solutions related to passenger services, airline operations, revenue management, merchandizing, passenger disruption management and digital experience. In addition, Vistara, the Indian carrier, contracted for Amadeus Network Revenue Management, while Nordica, a small Estonian airline, contracted and implemented the full Altéa PSS suite, as well as other solutions related to revenue integrity, digital channel and merchandizing. Air Burkina implemented the Altéa PSS and will implement Amadeus’ Digital Experience Suite. Also, Uganda Airlines implemented Altéa DCS and additional solutions, while Breeze Airways implemented Navitaire New Skies.

Hospitality

We continued to expand our portfolio of customers for our Hospitality solutions. Swire Properties Hotel Management, Siyam World and Millennium New York, signed for Amadeus Digital Media. Commercial activity included Marriot, signing for an expansion of our partnership by adding business intelligence solution Demand360.

New Businesses – Airport IT

The positive momentum in our Airport IT business continued during the second quarter of 2021, particularly related to touchless technology, which is helping our airport customers adapt to the new social distancing rules. Pristina International Airport (Kosovo) will automate the check-in and bag drop processes with Amadeus’ solutions. In the US, both Syracuse Hancock International Airport (New York) contracted for Airport Common Use Service (ACUS).Also, Kansas City International Airport (Missouri), contracted for Amadeus Biometric Solutions. Finally, Pittsburg International Airport (Pennsylvania) signed for the deployment of Amadeus Flight Information Display System (FIDS).

Liquidity enhancement and plans to strengthen Amadeus for the future

We remain focused on protecting our business and preparing it for the future. As part of our ongoing efficiency and cost-cutting programs, in the first six months of the year of 2021 relative to 2020, our P&L fixed costs (composed of personnel and other operating expenses) declined by €111.3 million (excluding the program’s implementation costs and bad debt). Capitalized expenditure, also part of our fixed cost reduction plan, declined by €56.6 million, (excluding cost saving implementation costs). In aggregate, to date in 2021, the total fixed cost reduction achieved relative to 2020, including both P&L fixed costs and capitalized expenditure, amounted to €167.9 million.

Amadeus’ first half of 2021 Free Cash Flow amounted to -€121.8 million, or -€47.0 million excluding cost saving implementation costs paid in the period.

Liquidity available amounted to c. €3.4 billion as of June 30, 2021, supported by cash (€1,488.9 million), short term investments (€871.1million) and an undrawn revolving credit facility (€1,000 million).

Summary of operating and financial information

Summary of KPI (€million) |

Apr-Jun 2021 |

Apr-Jun 2020 |

Change vs. Q2’20 |

Change vs. Q2’19 |

Operating KPI |

||||

TA air bookings (m) |

47.1 |

(19.1) |

n.m. |

(67.6%) |

Non air bookings (m) |

7.8 |

2.4 |

217.4% |

(53.4%) |

Total bookings (m) |

54.8 |

(16.7) |

n.m. |

(66.1%) |

Passengers boarded (m) |

164.9 |

31.3 |

427.6% |

(67.7%) |

| Financial results1 | ||||

Distribution revenue |

267.6 |

(15.9) |

n.m. |

(66.4%) |

IT Solutions revenue |

356.8 |

275.4 |

29.5% |

(42.8%) |

Revenue |

624.4 |

259.5 |

140.6% |

(56.0%) |

EBITDA |

145.3 |

(155.4) |

n.m. |

(75.3%) |

Profit (loss) for the period |

(35.0) |

(314.7) |

(88.9%) |

(111.8%) |

Adjusted profit (loss)2 |

(23.6) |

(231.0) |

(89.8%) |

(107.2%) |

Adjusted EPS (euros)3 |

(0.05) |

(0.51) |

(89.8%) |

(106.8%) |

| Cash flow | ||||

Capital expenditure |

(110.1) |

(113.0) |

(2.6%) |

(35.4%) |

Free cash flow4 |

(110.0) |

(462.1) |

(76.2%) |

(168.4%) |

Indebtedness5 |

June 30, 2021 |

Dec 31, 2020 |

Change |

|

Net Financial Debt |

3,255.8 |

3,073.9 |

181.9 |

|

[1] 2021 figures adjusted to exclude costs amounting to €4.2 million (€3.0 million post tax), incurred in the second quarter of 2021, related to the implementation of the cost saving program announced in the second quarter of 2020. See section 3 for more detail.

[2] Excluding after-tax impact of the following items: (i) accounting effects derived from PPA exercises and impairment losses, (ii) non-operating exchange gains (losses) and (iii) other non-operating, non-recurring effects.

[3] EPS corresponding to the Adjusted profit attributable to the parent company.

[4] Defined as EBITDA, minus capex, plus changes in our operating working capital, minus taxes paid, minus interests and financial fees paid.

[5] Based on our credit facility agreements’ definition.

- Results press release - H1 2021 The file will download automatically

TO TOP