-

Solutions

-

Airlines

-

Airports

-

Border Authorities

-

Corporate Travel & Expense

-

Integrations

-

Travel Sellers

-

-

Payments & e-invoicing

-

Traveler behavior is changing at every touchpoint.

Traveler behavior is changing at every touchpoint.Explore bold ideas, lead with cutting-edge tech, build powerful partnerships, and contribute to lasting impact.

Discover more

-

-

Support & Training

-

Already a customer?

Already a customer?Log into Amadeus Service Hub for product news, learning materials, and customer support.

Login

-

-

-

Amadeus Partners

Amadeus PartnersAt Amadeus, we value strong partnerships with different players across the travel ecosystem. Gain access to our solutions to develop your portfolio, reach new customers and add to your bottom line.

-

Landmark partnership between Amadeus and Google Cloud

Landmark partnership between Amadeus and Google CloudLearn how this collaboration strengthens Amadeus' multi-cloud approach and AI innovation to improve efficiency, reliability and growth in travel.

Read more

-

-

Resources

-

Trending Topics

-

Connected journeys: How will technology transform travel in the next decade?

Connected journeys: How will technology transform travel in the next decade?From AI-driven planning and biometric check-ins to smarter disruption management.

Read the report -

Six travel trends that will redefine how we travel in 2026 and beyond

Six travel trends that will redefine how we travel in 2026 and beyondAmadeus, in collaboration with Globetrender, unveils the tech, policy and innovation coming to transform the face of travel.

Discover now

-

-

Company

-

About Amadeus

-

Careers

-

-

Sustainability (ESG)

Learn how we’re working to make travel a force for good.

-

Amadeus Global Report 2024

Amadeus Global Report 2024Get an overview of our company in 2024 from a business, financial and sustainability perspective.

Access report -

-

-

Competition will be a reality from 2020 in the long-distance market for rail. In this blog post, Prof. Andrea Giuricin looks at already liberalized countries and expounds on the factors that national railways and new entrants must follow to get ready for 2020.

Passenger rail deregulation: chronology

There are only two countries in the world that introduced competition in the high-speed rail market: Italy and South Korea. Other European countries have opened access to competition in the long-distance sector: Austria, the Czech Republic, and Sweden.

In 2011, Westbahn entered the Austrian market, operating the Vienna to Salzburg route. In the same year,in the Czech Republic, the Prague-Ostrava corridor opened to competition. Leo Express and Regio Jet started sharing the line with the national incumbent.

In 2012,Italy introduced competition in the high-speed sector, when NTV Italo entered the market with 25AGV (Automotrice Grande Vitesse) train sets . So far, Italy, Austria, and the Czech Republic have experienced a positive passenger increase of 80% - 90% in less than 5 years for rail travel.

In Sweden, in early 2015, MTR express entered the market, operating the Stockholm-Goteborg corridor, increasing the demand by 20%. Lastly, in 2016, South Korea became the second country in the world to open access to high-speed rail competition, withSeoul's high-speed railway SRT . Its demand increased by 14% in less than one year.

Rail technology & innovation: success factors

So far, technology has been a key success factor in liberalized markets. Flexible rail technology solutions help new entrants and national railways to adapt their offer & pricing to new markets.

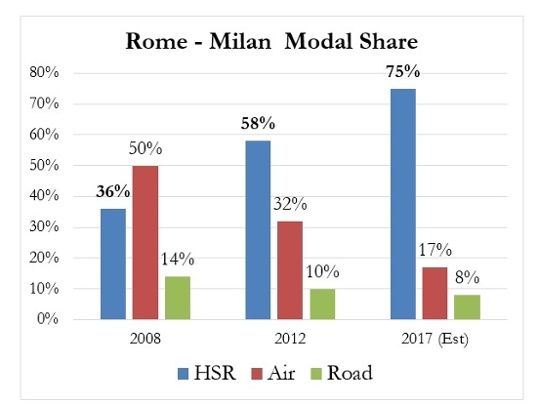

Aso,innovation has a strong weight on rail liberalization,not only within rail travel but also competing with other transport modes.In Italy, where the competition pushes innovation, the rail market share is increasing. On Italy's most important route, Milan to Rome, the train is taking away market share from the airplane, with a 75% market share, thanks to a much more innovative railway.

On the other hand, national railwaysalso have the possibility to answer to new competitors by adopting the right strategy:

- Having a customer-oriented strategyas an innovative rail revenue management and a seat inventory system could drive growth for national players.

- Having a digital strategy will help railways to manage cost control efficiently, but also to become more customer-focused.

Only if railways introduce innovation and use the right technology tools, will the rail market share increase. Soft technology investments are the success elements for tomorrow's railway. Rail technology is here, and it is waiting to be implemented to achieve efficiency in a more competitive market than ever.

TO TOP