With countries progressively lifting travel restrictions and border controls, our sights are set on getting business back on track. This is happening at different rates in different regions.

The COVID-19 crisis is completely different from any other we have recovered from. Its far-reaching impact on the global economy has brought the travel industry to an unprecedented standstill. The sudden drop in demand for travel created a global data void, creating new challenges forairline revenue optimization .And this forced us to adapt and rethink our approach to revenue management overall.

As airlines begin the journey to recovery, they are faced with a high degree of uncertainty related to passenger demand evolution. This, in conjunction with the challenges posed by the macro-environment, creates a major dilemma for airline senior executives. How do you optimize revenues when your historical data is no longer reliable for forecasting, travel demand is low, the economy is suffering, and countries are imposing different health and safety measures? To address this uncertainty, we need to develop a deeper understanding of the current operating environment and the factors that will influence recovery, which are often beyond an airline’s direct control.

Throughout the pandemic, my Business Consulting and Professional Services colleagues across the globe have been scenario-planning and forecasting different demand trajectories with airlines to develop the right revenue management strategies for recovery. In this unpredictable environment, we need to prepare the right networks, schedules, pricing, and demand management strategies to minimize revenue dilution and improve cash-flow. For this, it’s important to have agile market monitoring so we can learn from the variance between planned scenarios versus real consumer behavior. This is critical so commercial strategies can be quickly adapted, and we expect to see a lot of testing and learning over the coming months. Those airlines with the right set-up and flexibility to respond to the current environment are the ones that will emerge the strongest.

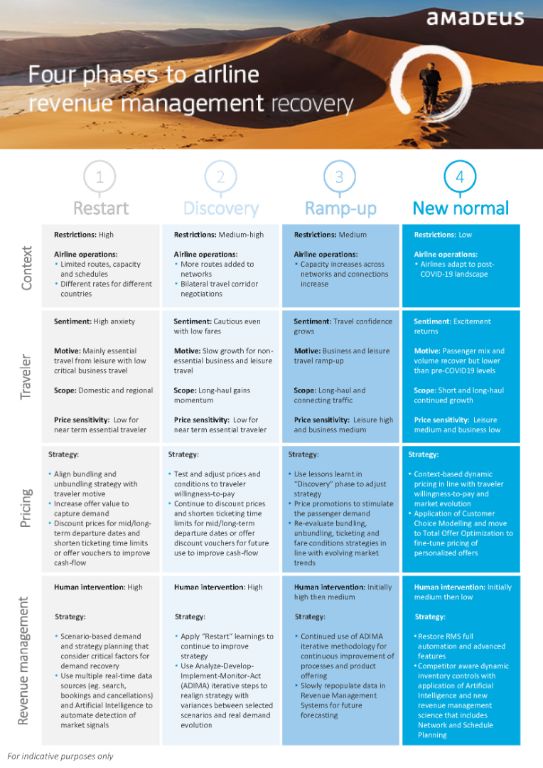

Our approach examines an array of factors that contribute to demand uncertainty during the airline recovery period and we continuously incorporate new data into our models as the market evolves. It’s about exploring the plausible scenarios ahead of us and evaluating the decisions that must be made for each, so airlines can capitalize on opportunities and minimize any business risks at the same time. We’ve been plotting the course around four phases:

Restart

This is where the world is at right now, with airlines either shyly taking to the skies again or planning to. In this phase, airlines resume flying on very limited routes with reduced frequencies and scaled-back staff. Here, pricing strategy is key to assess passenger willingness to pay and propensity to fly. Retail strategies, such as bundling and unbundling, loyalty programs, or ticket change conditions, need to be reviewed to encourage traveler demand. It’s also important that airlines communicate on health and safety measures to improve traveler confidence.

The context is characterized by high uncertainty, high market volatility, and weak traveler confidence. All these make accurate forecasts on demand, bookings, and revenue very difficult. With historical data out the window as a baseline reference, close attention should be paid to real-time search and booking activity, customer behavior, pandemic data, and country travel restrictions.Machine learning is key to lightening manual intervention, compensating for reduced staff and resources, and improving decision-making to stay ahead of the competition during these uncertain times.

Since demand is low at this stage and airline operations limited, we lose granularity when it comes to demand forecasting. Whereas under normal circumstances airlines would perform detailed city to city forecasts and adjust revenue optimization accordingly, in this context they will have to evaluate demand at a higher level, such as country to country. Airlines should maximize availability to capture as much search and booking data as possible to determine the right revenue optimization strategies for the observed market behavior.

Discovery

In this phase, the objective turns increasingly from intelligence gathering to capturing revenue opportunities. As more travel restrictions are lifted and consumer confidence increases, we begin to see more traffic and more route openings with more frequencies and more network connections. But still at a limited level. Airlines should continuously monitor the market’s evolution and identify any variance with their scenarios, to improve their demand projection processes and adapt their product offers.

Again, moving into this phase will happen at different rates in different markets and will also differ between business and leisure travel. We expect leisure to take-off first, specifically the “visiting friends and relatives” (VFR) segment. To capture these revenue opportunities, it’s important that airlines continue to stay close to the market’s booking activity and recovery signals so they can quickly adapt their tactics.

Since booking volumes will be on the increase in this phase, airlines will have more data to begin steering their revenue management approach at a more detailed level, such as from city to city instead of country to country, and with more agility.

Ramp-up

Here, we may begin to see the light at the end of the tunnel with increased traveler confidence translating into a higher propensity to fly. As the market progresses from phase two, airlines should focus and act on new demand levels and evolving consumer behavior.

At this stage, airlines will ramp-up capacity and strengthen their networks with increased frequencies and connectivity. Traffic will start to stabilize, and most origin and destination markets begin to recover at a more reliable level for future forecasting purposes. However, demand is likely to be less than pre-COVID-19 levels.

Consumer purchasing behavior is likely to have changed too. We expect to see more people booking closer to departure than pre-COVID-19 but with less willingness to pay. We also expect leisure travel to continue to be stronger than business travel at the early stages of this phase.

Revenue management systems will need to be capable of understanding all these changes and to learn from them so airlines can adapt their strategies accordingly to capture even more revenue opportunities. Manual intervention begins to decrease significantly as we recover more revenue management automation capabilities and richer forecasting features.

New normal

During this stage, stable traffic with normal seasonality will see revenue management’s full features, principles, and automation restored. Although we don’t know exactly what the new normal will look like, we do know that our revenue management science and technology will be enriched with even more sophisticated workflows, practices, and data sources.

While COVID-19 forced us to reset revenue management practices, changes to consumer behavior, the market, and technology were already pointing towards the need for evolution. And the good news is that our R&D teams were already enhancing our models and algorithms to integrate new data sources that help airlines adapt to dynamic market conditions. While they continue to evolveour revenue management solutions, the groundwork to date allowed us to be closer and more responsive to our customers’ needs throughout the pandemic.

For more details,listen to my recent podcast below withThomas Fiig, Director and Chief Scientist at Amadeus, andBenjamin Cany, Director of Offer Optimization at Amadeus, where we explore why COVID-19 is so different to any other crisis we have overcome and what that means for airlines; more recommendations to help airlines navigate these difficult times; and the innovation that lies ahead for revenue management science and its integration with other areas, like network and schedule planning.

Don’t miss out, follow our new Amadeus for airlinesLinkedIn channel for more updates, and stay tuned to Thomas Fiig’s upcoming blog post where he will dive deeper into the evolution of revenue management science and what’s bubbling away in the Amadeus Airlines R&D lab!

Note to Amadeus airline customers: All user guidelines and recommendations produced to help airlines optimize the use of our technology, including revenue management, during this pandemic are available in the Airline Product Tips section on the Amadeus Service Hub (link available to Amadeus customers only).

TO TOP