The objective of airline revenue management has often been defined as determining “the right price, for the right product, for the right customer, at the right time.” While airlines have made tremendous advancements over the last 40 years in revenue management and dynamic pricing science, this objective is not entirely delivered today.

This is because today, airlines rely on a two-step process to distribute their products: first by publishing fares with fare distributors, followed by computing which of these fares are available for sale. This design is highly scalable and efficient, and enables the airline to display pre-constructed, static bundles of products – for example, “Economy Basic” and “Economy Standard”– each of which contains pre-defined fare conditions and ancillary services. However, this also means that all customers receive the same selection of bundled offers, and the offers are not personalized or contextualized to the customer making the request.

IATA has formulated a vision fordynamic offer creation (Touraine and Coles, 2018) that will enable the industry to move their retailing experience closer to those of sophisticated online retailers that offer personalized and contextualized offers to their customers. By creating relevant offers to display to each customer and by setting the right prices for these offers, airlines can expect improvements both in conversion and expected revenue while also improving the customer experience.

An unsolved problem… until now!

This vision requires advancements in both distribution technology and offer optimization science. On the distribution side, these advancements come with the adoption of the New Distribution Capability (NDC). Adoption is growing in the industry andIATA has targeted a full shift to the framework by 2030 .

On the science side, however, there has been a gap. Retailing today is typically driven more by rules of thumb rather than by science when it comes to bundling. This is due to lack of a tractable scientific model that determines what products to bundle and how to price these bundled offers. This problem had remained unsolved for decades – until now!

A successful collaboration with the Massachusetts Institute of Technology (MIT) on offer optimization science has resulted in a breakthrough new approach – removing some of the obstacles and enabling dynamic offer creation to be employed in practice. This will finally allow airlines to deliver on the revenue management objectives stated above.

Setting the scene for dynamic offer creation

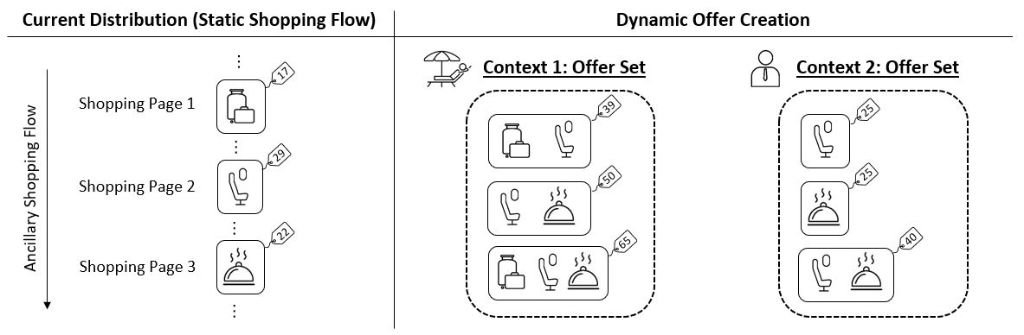

Let us compare how ancillary services are displayed to customers with either a traditional or a modern retailing approach, see Figure 1. With traditional distribution (left), all customers receive the same static offers in the same order and at the same prices. Offers are displayed on sequential shopping pages, where a customer first selects a bag, then a seat assignment, and so forth, without considering possible complementarity between the products.

NDC-enabled distribution (right) offers airlines the ability to move beyond these pre-defined service offerings. With NDC, airlines can vary the offer set that is shown, depending on the customer segment and travel context – which provides information of which products and services that are of interest to each customer. For example, since a checked bag may not be as relevant to a business customer on a short-haul trip than to a leisure customer traveling with family, the offer set displayed to the business customer may not contain offers including a checked bag.

With NDC, dynamic offer creation allows the airline to construct the most relevant offer set, while allowing the airline to upsell to bundled offers by removing some offers from the offer set or pricing them unattractively.

Figure 1 illustrates two such offer sets each with three offers: {{bag, seat}, {seat, meal}, {bag, seat, meal}} and {{seat}, {meal}, {seat, meal}}. Note that the same offer – the bundle {seat, meal} – is priced differently in the two offer sets: $50 and $40 respectively. This highlights a critical challenge in offer optimization – the price of an offer depends on the offer set it is contained within.

Why is offer optimization so complex?

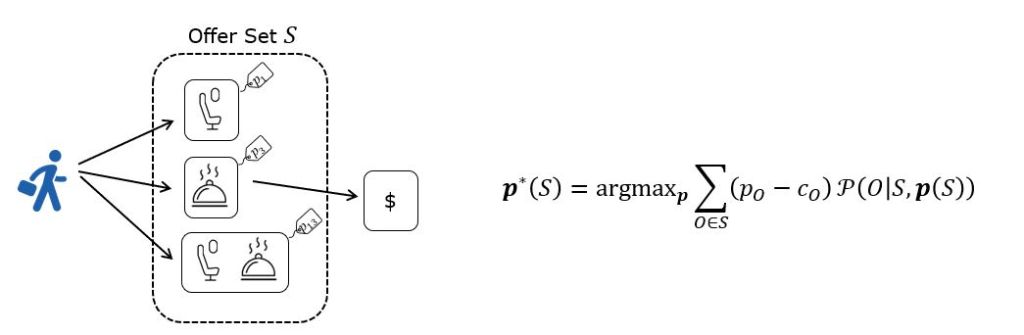

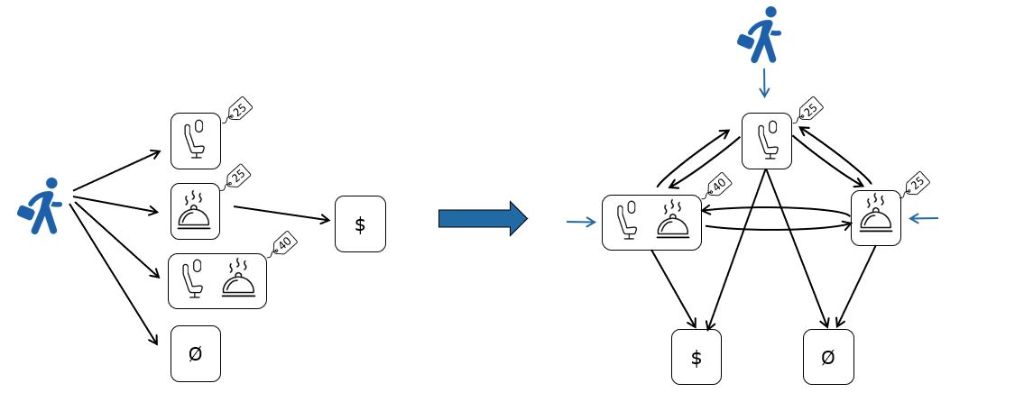

To understand why optimizing prices of offers in an offer set is a difficult challenge, consider the customer in Figure 2 who is choosing between three offers in an offer set. Let’s use a bit of math to represent the probability that the customer picks one of these offers out of the full set. We’ll start with some notation to make it easier to talk about the problem.

Let S represent the offer set; in this case, S = {Seat, Meal, Seat & Meal}. The probability that a customer picks an offer O (for example, O = Seat) depends on two things: the other offers in the set S, and the prices p(S) of all the offers in the set (for example, p(S) could be {$16, $25, $35}). We represent the probability that a customer chooses an offer with the purchase probability function P(O|S,p(S)). For example, if P(Seat|{Seat:$16, Meal: $25, Seat & Meal: $35}) = 0.35, the customer has a 35% chance of selecting the Seat out of all the offers in the offer set. Note there is also an option for the customer to leave without buying anything.

Our goal is to find the prices that will give the airline the most net revenue from this offer set. We start by multiplying an offer’s net revenue (p_O – c_O), where p_Ois the offer’s price and c_Ois the cost to the airline to provide the offer, by the probability P(O|S,p(S)) that the customer picks that offer out of the set. This gives us the expected net revenue for that offer. Then we add up the net revenues from all the offers to get the total expected net revenue for the offer set, as shown in the equation in Figure 2.

Now we just have to find the prices p*(S) that maximize the net revenue for the offer set. Seem easy? Remember that the optimal price for an offer depends on all of the other prices in the offer set, which means we have to simultaneously optimize all the offer prices at once.

Unfortunately, these types of multi-dimensional optimization problems (where we optimize all of the prices for all the offers together) can be very difficult or impossible to solve in practice, which represents a roadblock for the airlines.

A breakthrough approach to price optimization

Starting in 2019, Amadeus’s chief scientist Thomas Fiig and I worked with Kevin Wang, a Ph.D. student at the Massachusetts of Technology (MIT), to find a solution to this challenging problem. Our resulting paper,"Dynamic Offer Creation for Airline Ancillaries Using a Markov Chain Choice Model" , was published in the Journal of Revenue and Pricing Management and was selected as the winner of the2022 Anna Valicek Award at the 62nd Annual AGIFORS Symposium in Toulouse, France.

This may seem like an unusual or even bizarre way of modeling customer choice – after all, we normally assume customers to be rational, to simultaneously assess all of their alternatives, and to subsequently select the offer that they like the best. However, it turns out that with the right choice of parameters, we can use this model to represent virtually any type of customer behavior. And more importantly, this model has some special properties that reduces the multi-dimension optimization problem to a series of one-dimensional optimization problems, which enable us to easily solve for the optimal prices.

Our findings

We tested the performance of our new model with a number of simulation experiments. First of all, we found that the model worked as expected – it produced logical prices for bundled offers and was able to quickly optimize the prices of even large offer sets. Moreover, when we simulated the revenue performance of our model compared to a state-of-the-art a la carte pricing approach (where each ancillary is priced individually and no bundle discounts are given), we found that our model shows significant revenue improvements.

Our simulations also expose some important insights. The revenue benefits can be traced back to two strategies: showing customers relevant offers and nudging customers towards more profitable bundled offers (by pricing the bundled offers attractively relative to the a la carte offers).

While these two approaches are indeed employed heuristically in airline retailing strategies, our work demonstrates the first science-based computations. Interestingly, the model was not told to employ retailing strategies – it figured it out on its own based on revenue optimization. And consequently, while a heuristic-driven approach is limited to “rules of thumb” or “gut feeling” – the benefit of a science-based model allows us to dynamically bundle and price offers optimally.

We believe our work is an essential brick that will enable the airline industry to make its transformation into the modern retailing era. Now, we’re looking forward to testing the model in real life!

TO TOP